Thursday

Gold, Yuan, Drugs

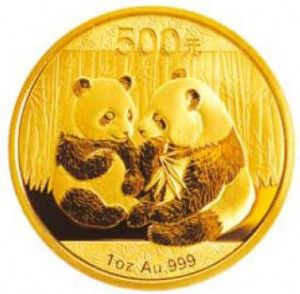

Many years ago (five? ten?), I was at a law seminar. One of the presenters decided to make a funny quip by referencing a certain group of nutty people who have about as much of a grasp on reality as people who want a return to the gold standard. I remember thinking it was an odd analogy, but because I didn't know much about the Federal Reserve scam, I didn't think much of it. In retrospect, it was an alarmingly ignorant thing to say, made even more disturbing since he impugned an entire class of intelligent thinkers who, though in a minority, are not nuts and have a lot of good reasons for supporting a gold standard. It was also short-sighted, obviously, in light of what we've been seeing from the Bernanke, which has brought many gold standard proponents into mainstream publications. In the past week, both Forbes and the Wall Street Journal have run pieces that are sympathetic to the gold standard. From the Forbes blogs: The Dollar Sets; Gold Also Rises. From the Wall Street Journal: Why the Dollar's Reign Is Near an End. The latter is not a "pro-gold" piece per se, but if the dollar's reign ends, something will replace it and many people think it will be a gold-based currency of some sort. I, incidentally, doubt that the dollar's role as the reserve currency will end, since the currency of the premier world military power has always enjoyed reserve currency status. Due to technology, such historical rules might change, but I have a prejudice: I take history over innovation. It's not necessarily a good prejudice, but we all have 'em and this one has normally served me well. * * * * * * * Yuan Rising? Instead of a gold-based currency, could the Chinese yuan become the new currency? I'm told a person can go into the Bank of China at 410 Madison Avenue (at 48th and Fifth) and buy yuan. I'm going to try it when I'm in New York. I'm not sure it makes financial sense to hold onto paper yuan, but it's a novelty investment. Plus, some people speculate that China is hoarding gold so they have enough of it to give their currency gold backing, which would increase its attraction dramatically (and enhance my novelty investment). Of course, China is experiencing severe growing pains, including drug problems. Check out Paul Johnson's opinion piece in the March 14th Forbes. Johnson points out that prosperity and drug use always rise together, and China is no exception. Opium is back strong, along with a bong full of other drugs. With it has come organized crime and a retaliatory war on drugs. And the Commies don't screw around. One expert thinks they may have executed over 250,000 criminals since 1975 ("the total number [executed during the last quarter of the 20th century] may have been as high as 250,000"). * * * * * * * QE Ending? Zero Hedge ran two articles in the past 48 hours, stating that there are indications that the Federal Reserve might end quantitative easing. If that happens, all investments except cash will probably get slaughtered. I'm not sure what to think, but I did shift about 2% of my portfolio into cash and SH. Here are the posts: The Coming Rout and Exclusive: Bill Gross Dumps All Treasuries, Brings Total "Government Related" Holdings To Zero, Flees To Cash - No QE3? The first piece is a bit lengthy, but very interesting. The second piece is short and punchy.