Wednesday

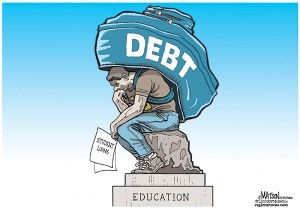

Crushing the Youth

This article about the "college tuition bubble" is interesting, but its content doesn't support its assertion. The assertion: College tuition is in a bubble that is about to get pricked. The content then gives eight reasons why college tuition is outrageously priced, but only one of the reasons explicitly supports the idea that the bubble is about to get pricked:

According to Bloomberg, publicly traded higher education companies derive three-fourths of their revenue from federal funds, up from just 48 percent in 2001 and approaching the 90 percent limit set by federal law. The fact that colleges are almost completely relying on borrowed money to finance tuition, up to the legal limit, means we've almost hit the breaking point. If not for the easy student loan money sloshing around, many colleges would go belly up tomorrow.

Of course, grossly-rising prices generally tend to get resistance from market forces. At some point, people just figure the price isn't worth it. If that happens, a pop or deflationary puncture could develop: if people stop going to college, colleges will have to lower prices to attract students. Even better, if people stop going to college, the trend could catch on, leading more to a sudden pop than a slow leak. Or people could start demanding lower-priced alternatives, which could lead to cheaper online options (which are available, but the education establishment blocks them with protectionist accreditation requirements). Thing is, both of those market-correcting forces can be overcome--or at least resisted--by the Establishment. Such resistance leads to gross distortions, but that doesn't stop the Establishment. It's still throwing tons of money at the schools and talking about making college education available for all Americans, even though its flood gate of money has already distorted the prices in this area. * * * * * * * Bankruptcy. The whole bankruptcy disposition toward student loans, incidentally, is an outrage. The premise of the Bankruptcy Code is that people ought to be given another shot (or many shots, one every six years, if that's what they want/need). If you're a 45-year-old man who has too much credit card debt and two snowmobiles, three big-screen TVs, and a four-bedroom house, you're protected. The Bankruptcy Code takes away your credit card debt and lets you hold onto all the toys and a chunk of equity in your house (legally, the toys are "fair game," but as a practical matter, bankruptcy trustees rarely go after them). But if you're a 22-year-old kid who took student loans to pay for college? Screw you. You don't get a second chance. Why? There's only one reason: the federal government wants to encourage lenders to make the loans, so its pet project (colleges and universities) get more money. The federal government doesn't care about the kids who are strangled with college debt (on average, for the 2/3rds of kids who graduate with student loan debt, $23,000). It only cares that their patrons at the colleges and universities get flooded with money. Again, it's an outrage. * * * * * * * It's Just Another Example of the Beast at Work. The more you sit down and contemplate the myriads of ways that the federal government slants the table to favor its constituencies, the more you come to the conclusion that we need to dismantle the beast. The only reason the average person tolerates the beast is because of Communism and its totalitarian brethren: by comparison, the U.S. system is so much better than what happened behind the Iron Curtain, so much better than Nazi Germany, so much better than China and North Korea today. We look at those alternatives, and our minds tend to develop a false dichotomy: either our system or theirs. It doesn't really cross our mind that there are other ways, like a system of strong states that make their own economic policies without federal encroachment. We oughtta give it a try (another try, actually). Each state can tax its citizens to oblivion (NY and California), if they want. Each state can eliminate income taxes (Wyoming and Florida) and instead rely on tolls, escheats, fines, and sales taxes. People can then pick what states they want to live in. As the Socialist-inclined states start to wallow, they'll change their ways. And hey, if the free-market-inclined states are wrong (ha ha), they'll wallow until they change their ways.